We do a review of Monzo Flex and discuss its features.

Buy now pay later

Monzo Flexi is a buy now pay later credit card. Manzo is an app based bank that is now popular in the UK and used by thousands of customers.

Monzo was formed in 2017 as a challenger bank to provide an alternative form of banking. Monzo is a proper bank that is FSCS protected in the UK.

How does Monzo flex work?

Monzo Flex is a credit card and it provides you with the facility to buy something and pay for it in 3 monthly payments.

But, what sets it apart from some buy now pay later providers is that you are not limited to certain places where you can use it. With the Monzo Flex Card, you can shop in any store or buy something online.

If you need more time to pay for your purchase than the 3 months, then you can extend your payments to 6 or 12 monthly payments at 29% AP’R representative (Variable).

Is my purchase protected?

Items purchased with the Monzo Flex card is protected if eligible. It has the Section 75 Protection for eligible purchases that you make with your virtual card. As with a credit card.

This will provide you with the same protection as a credit card when you buy an eligible purchase.

Award winning credit card

The Monzo Credit Card was awarded the ‘credit card of the year 2023’, according to the Monzo website. The card does not have any hidden fees and comes with a credit limit of up to £3,000. You can make any items that you purchase into a buy now and pay later purchase if eligible.

If you need a new computer or washing machine, then you can buy now with the Monzo Flex Card and pay later.

Flexibility to pay

You can transfer any purchases you have make with your Monzo Current Account to your Monzo Flex with a single click in order to pay in monthly payments. However, you have to transfer it within 2 weeks of the purchase.

If you have bought an item with your Monzo Current Account but feel you cannot afford to pay for it all together, you are able to spread the cost by transferring the purchase over to your Monzo Flex Card. This is a nice option to have.

If you have not made your payment, Monzo will not charge you. You will get up to 7 days to make your payment. If you still have not paid, then if you are on a 3 months or a 6 months payment plan, Monzo will move you to the 12 months payment plan.

If you want you can pay extra or pay back quicker in order to save yourself from paying some interest.

Use abroad with no extra fees

You can use Monzo Flex in the UK or abroad in any currency. In addition, it is fee free. That means Monzo does not add any mark-up on the Mastercard’s exchange rate.

This could end up saving you money as you will be spending at local currencies with the Mastercard’s exchange rate.

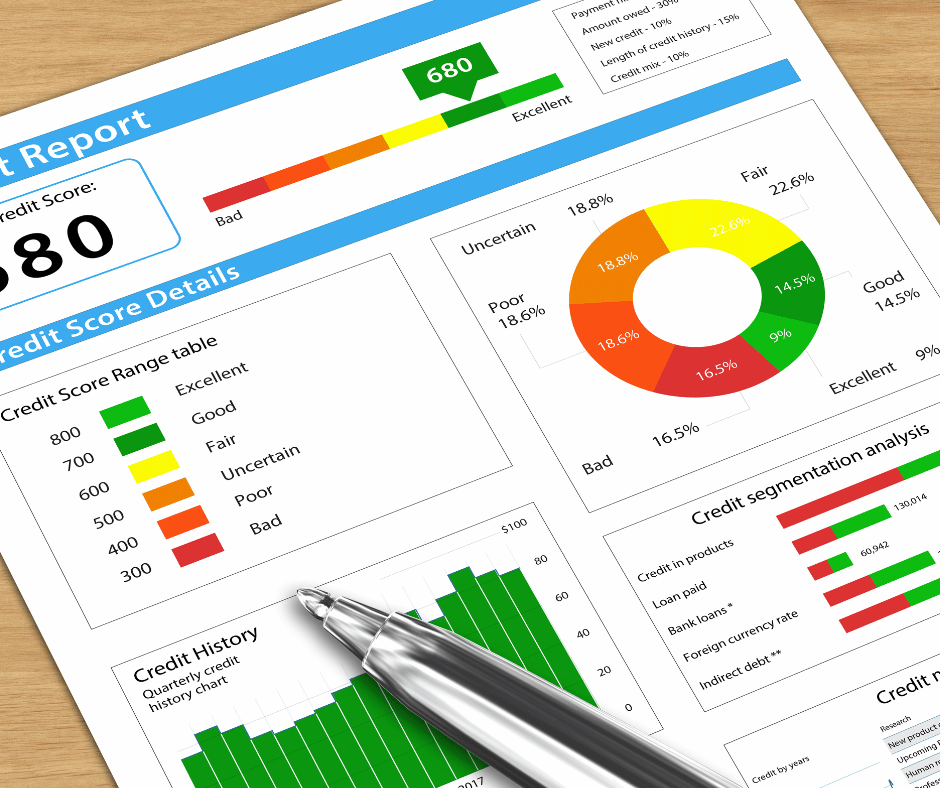

Non payments

Consider before buying that any purchases that you make with Monzo Flex needs to be paid back. You should also consider if you will be able to make these payments. If you do not keep up with payments it could affect your Credit Rating.

In addition, any unpaid debt could be moved to a debt collecting firm.

Comment

Monzo Flex gives you the facility to buy now and pay later. Unlike some buy now pay later providers, you are not restricted to purchasing from certain stores.

You can also spend with your Monzo Flex Card abroad in any currency without being charged any additional mark-up on the Mastercard’s exchange rate.

You are also able to manage all your transactions through the Monzo app.

Additional Information

Money Advice Service

For debt management and advice on how to pay for bills go here: Money Advice Service info page.